- Make sure your repayments is said. Before you apply getting a subprime financing, ask when your bank accounts your bank account into about three individual credit reporting agencies: Experian, TransUnion and you may Equifax. That it guarantees your own on the-date payments arise in your credit score, which can only help to improve your own borrowing from the bank.

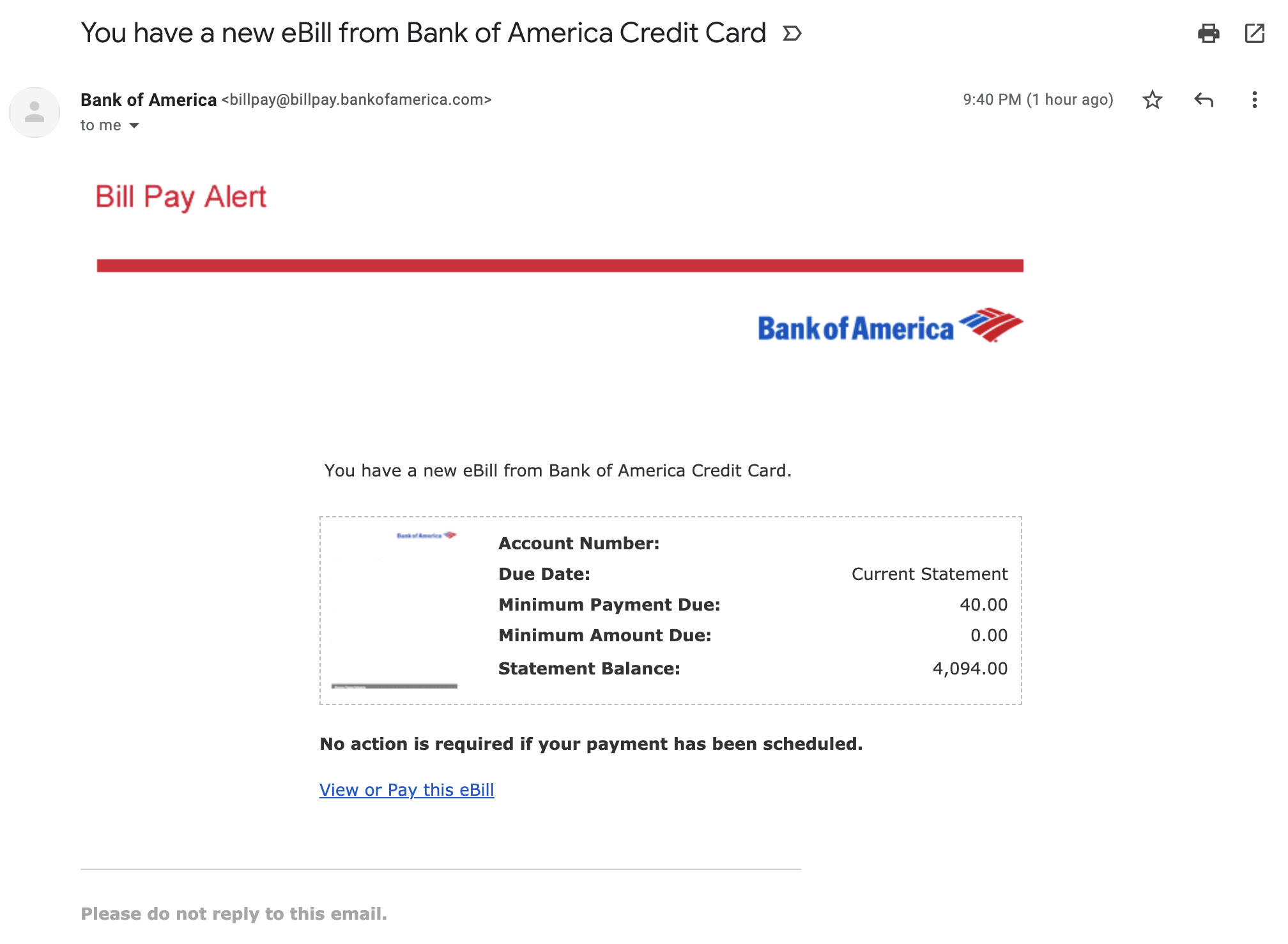

- Usually help make your financing percentage on time. To eliminate lost a repayment, put reminders, put the loan due date in your schedule otherwise set up an automated commission from your checking account. (Just be sure to have enough money regarding the account in order to defense brand new commission.) The fresh timeliness of your costs ‘s the solitary most significant cause for your FICO Get.

- Should you miss a repayment even with your time and effort, try not to worry. Instead, shell out it soon too. Late repayments aren’t said to help you credit reporting agencies up until he could be 30 days past due. Even if you be billed a late fee and you may deal with almost every other charges, an installment that’s a couple days past due should not apply at your credit rating.

Getting an excellent Subprime Financing

Loan providers features additional meanings of subprime borrowers, so checking your credit rating would not make you a definitive answer to your where you are, it provides you with a good idea. When your credit rating drops at the upper end of one’s subprime diversity, you can aquire finest loan terminology of the postponing the loan software a while even though you strive to alter your credit rating. (Much more about you to later on.)

Look Lenders

You can purchase subprime loans, credit unions otherwise on line loan providers. Your financial is an excellent starting place but be certain that evaluate money out-of various sources. Such as for instance, discover firms that are experts in subprime funds. Envision borrowing from the bank unions, and that never charges over 18% with the subprime loans-less than additional loan providers. Oftentimes, you will need to join the credit commitment, and therefore typically means opening an account, one which just make an application for financing. You want a beneficial subprime personal bank loan otherwise car finance? You can save a bit by using Experian CreditMatch, a free tool that presents the loan providers that might be suited for your according to your credit rating.

Research rates

How to try to become approved to have a subprime loan is to utilize for a few of these. Each application for the loan produces a hard query on your own credit history, which can temporarily reduce your credit history. But not, for many who over all of your current software within this 2-3 weeks, credit rating designs often dump all of them in general query, so that you will never be punished getting research looking. FICO will count all of the applications registered in identical 45-date period as one inquiry; VantageScore will provide you with 2 weeks.

Get ready

According to financial, you may have to give documents such a current spend stub showing your income, contact information from your own boss to verify their a job, or family savings statements to verify your own possessions.

When you’re having difficulty getting accepted to own good subprime mortgage, find out if the financial institution will allow somebody who has a good credit score in order to cosign toward mortgage with you. Just like the cosigner would-be accountable for paying down the borrowed funds in the event the that you do not, additionally the mortgage will look on the credit score, cause them to prepared to make exposure.

On your look for that loan, watch out for payday loans and automobile identity finance. Such finance may charge interest rates of 400% or loans Upper Bear Creek CO more, in addition to highest fees, and will make you deeper indebted than before or bring about one to eradicate crucial property.

Leave a Reply